Introduction

We first published this legal guide following the sweeping changes made to the UK sponsorship system in December 2020. You might remember that’s when sponsorship was rebranded from its old identity as the ‘Tier 2’ system, to the new ‘Skilled Worker route’.

This guide has remained popular in the intervening years. We’ve updated it here and there with various tweaks made to the sponsorship system, and of course as we accrued valuable experience working with the new system.

2023 was a particularly successful year for our clients, as Truth Legal helped over 75 businesses to obtain a sponsor licence and sponsor overseas workers. 2024 is shaping up well, too.

April 2024 saw a further wave of significant changes to sponsorship, particularly in the realm of minimum salary – gulp.

In this legal guide, we don’t just copy-and-paste from gov.uk. Instead, we’ve tried to simplify what’s out there and combine it with our practical experience, to give you information which is authoritative, accurate and accessible.

Whether you want to go it alone and apply for a sponsor licence yourself, or use our expertise, you’re starting in the right place.

|

How sponsorship changed in April 2024 |

|

How to Use This Guide

If you are reading this legal guide then your primary concern is to get a licence in place, whether that is to allow you to hire a specific individual or to make you well-placed to hire in the future. Whilst obtaining the licence is itself a challenge, getting the licence is just one step in the sponsorship process.

So as you read this guide, we’d caution against focusing purely on the licence application. Key Personnel, Certificates of Sponsorship, and compliance are all covered in this guide, along with lots of other useful information that shouldn’t be overlooked.

Remember that neglecting other aspects of sponsorship could mean your licence application is refused, or, even if your application is granted, your licence could be taken away at a later point if the Home Office does not think you are taking your role as a sponsor seriously. If your licence is revoked then you must also terminate any sponsored individuals’ employment. This could be devastating for your sponsored worker(s), not to mention the business disruption it may cause for you.

Who Can I Sponsor?

Before you enter the world of sponsorship, you need to understand which roles can be sponsored and how much you will need to pay. April 2024 saw minimum salaries hiked across the board, with few exceptions.

Getting the role right is still essential and should normally be your first port of call. When you assign a Certificate of Sponsorship you specify a role, and then the worker is tied to that role. If you want the worker to do job tasks far outside of the role for which they are sponsored, they will normally need new sponsorship.

Getting the Right Role and Pay: Our Three Step Guide

Step 1: Identify the job category and SOC code

You need to be clear about which job classification the job falls under. Note that the Home Office is concerned about the substance of the work being done, rather than the label.

It is important to get the role correct, as the Home Office could revoke your licence if they decide that a sponsored worker is performing a role that does not match the occupation code or job description on their certificate of sponsorship.

To complicate matters further, a new system of SOC codes was introduced in April 2024. So the SOC code you need today might be different to the code for the same job role pre-April 2024, confusing.

Important examples:

- Care Workers – formerly 6145, now 6135.

- Senior Care Workers – formerly 6146, now 6136.

- Restaurant Managers – formerly 1223, now 1222.

- Chefs – happily unchanged, formerly 5434, now still 5434 – a small win for the restauranteurs.

I personally find it somehow more confusing that the new codes are so similar to the old, often just one digit out! Extra care should be taken here (note to self).

Struggling with the SOC code?

Often, employers struggle with getting the correct SOC code. You might have a job title which is not recognised as an occupation on Appendix Skilled Occupations.

The Office for National Statistics handles the classification of jobs. Go to the ONS website and use their helpful search tool, for further job roles and SOC codes. You might even mention your efforts to use the ONS search tool in your sponsor licence cover letter – show the Home Office you have seriously considered this issue!

Step 2: Skill level

When we talk about minimum skill level, we’re talking about the level at which a job is recognised by the Home Office as being capable of sponsorship. It used to be degree-level or above, now it’s A-level or above. Although this means a lot more jobs are now capable of sponsorship, if the Home Office thinks a job role doesn’t meet the skill level, you won’t be able to sponsor someone to fill that job role.

So how do you know if a job is skilled enough to be sponsored? Well, the Home Office has decided for you, and its list of eligible jobs is here. If the job you want to sponsor is on the list, then it can be sponsored. There’s no need for a worker to actually hold an A-level qualification.

Step 3: Identify the appropriate rate of pay

Deep breath advisable here.

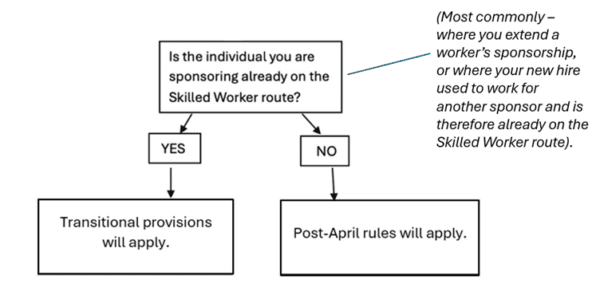

There are essentially two systems which exist post-April 2024: (1) the post-April 2024 system in full, or (2) the more generous ‘transitional provisions’.

My colleague has been referring to the post-April 2024 system as ‘full fat’. I wonder if, by the same token, transitional provisions should be thought of as Coke Zero, or some kind of low-fat Greek yoghurt…

Anyway, before we get into the detail of the two systems, you first need to determine which system applies to you.

We’ve designed this handy flowchart, enjoy:

Whichever system you’re working with, you must pay your sponsored worker a basic rate which is equal to or greater than each of the following:

- the general minimum threshold, set at the same rate for all occupations (discounts might apply);

- the going rate, which varies depending on the job role; and

- a minimum hourly rate.

Remember also that the Home Office only takes account of basic pay in its assessment of whether the minimum salary requirement is met. Allowances, overtime and bonuses are excluded, even if guaranteed.

Finally, don’t forget to pro-rata. The general minimum threshold is good for anything up to 48 hours per week, but must be pro-rated upwards if your worker will work in excess of 48 hours per week.

By contrast, the going rate is based on a 37.5 hour working week, and must be pro-rated for anything which isn’t a 37.5 hour working week.

More info, and the all-important numbers, below. It’s a lot to take on board, so we’ve also included a summary table at the end of this section.

Transitional Provisions

If you’re assigning a CoS after 3 April 2024, and you’re sponsoring a worker already on the Skilled Worker route (i.e. extending sponsorship or switching employers), the transitional provisions will apply to you.

Transitional provisions are your friend. Yes, there are still salary increases, but these are far more generous than the post-April 2024 system.

Under transitional provisions, the general minimum threshold increases from £26,200 to £29,000. Going rates also increase, but far more moderately than the post-April 2024 system. The hourly rate increases to £11.90, again more palatable than the post-April 2024 rate.

An example might help:

Joe has been sponsored by his employer since 2023 as a Restaurant Manager. His employer now wants to sponsor him for an additional three years, assigning the CoS after 4 April 2024.

As Joe is already on the Skilled Worker route prior to 4 April 2024, he qualifies under the transitional provisions. When Joe’s employer next assigns a CoS post-4th April 2024, they will need to pay at least £11.90 per hour and meet the general minimum salary threshold in transitional cases of £29,000.

The General Post-April 2024 System

Full-fat Coke, here we go.

These rules apply to new hires with a CoS assigned on or after 4 April 2024.

The new general minimum threshold is an eye-watering £38,700. Going rates are significantly hiked, and the new minimum hourly rate is upped from £10.75 to £15.88. Whew.

Again, an example might help:

Dave will be sponsored after 4 April 2024 as a Business Development Manager. He’s not already on the Skilled Worker route. His employer decides to set his pay at £50,394.24 based on 36 hours per week, complying with the following minimum salary threshold considerations.

The general minimum salary threshold of £38,700 (up from £26,200).

A going-rate (specific to the occupation code) of £26.92 per hour (up from £12.10).

In this instance, it is the massively hiked hourly rate of £26.92 which is the chief concern. Salary workings as follows: £26.92 x 36 (hours per week) x 52=£50,394.24.

Discounts

As April loomed, we weren’t sure if salary discounts would survive the impending changes at all, and even if they did, what would be left.

Fortunately, much of the salary discount regime has been retained, although it does look quite different in places.

For example, the new entrant rate used to be a general minimum threshold of £20,960, and 70% of the going rate for the occupation. It’s now £30,960 and 70% of the (increased) going rate, which is still very welcome.

Further, the Shortage Occupation List (SOL) has been rebranded as the Immigration Salary List (ISL).

The good news: inclusion on the ISL reduces the general minimum threshold to £30,960. The bad news: the new ISL contains far fewer job roles than the old SOL, and most importantly, inclusion on the ISL does not bring any discount to the going rate.

Full details on all the available discounts below, but first a word on ‘Options’. Everything we’ve talked about so far is the standard position if no discounts apply. The Home Office calls that Option A. The discounts are each given their own Option, as per the headings below.

Relevant PhD (Option B)

You may be able to pay less if the person you want to hire has a PhD. The requirements are that:

- The individual has a relevant PhD or other academic doctoral qualification (or overseas equivalent).

- The job is ‘eligible for PhD points’ – again you will need to refer to Appendix Skilled Occupations to see if the job is eligible. A surprising number of jobs which you might not think of as PhD level, are in fact eligible.

Note that you will need to give a ‘credible explanation’ as to why the PhD is relevant to the job. This explanation should be given at the point at which you assign the certificate of sponsorship.

If these PhD criteria are met, then you can pay a minimum of £34,830 or 90% of the going rate.

Relevant PhD in a STEM subject (Option C)

If your new hire is doing a job which is eligible for PhD points and has a relevant PhD, or other academic doctoral qualification, in a STEM subject, you can pay a minimum of £30,960 or 80% of the going rate, whichever is higher.

Immigration Salary List (formerly known as the Shortage Occupation List) (Option D)

This is one of the biggest discount changes, and unfortunately the change is not a good one for sponsors.

What strikes you first when you look at the new Immigration Salary List is just how short it is.

Fortunately, Care Workers and Senior Care Workers have made the cut, but some other surviving job titles are niche at best – archaeologists, fishing industry jobs, high-integrity pipe welders (???), racing grooms (presumably something to do with horses, and not someone late for his wedding), deckhands on large fishing vessels of specifically nine metres or above, (it actually says that), you get the idea.

Compare this to the old Shortage Occupation List, which included far more commonplace job titles like engineer, IT analyst, vet, architect – at least I know what those are!

In fact, 30% of sponsorship-eligible SOC codes appeared on the old Shortage Occupation List. But just 8% appear on the new Immigration Salary List, reflective of the Government’s intention to scale back eligibility for discounts based on job role alone.

As we noted above, inclusion on the Immigration Salary List (ISL) reduces the general salary threshold from £38,700 to £30,960, but there’s no longer a discount to the going rate, and the minimum hourly rate of £15.88 is unchanged for job roles on the ISL.

We’ll see how it pans out, but I predict that the ISL will be of limited to use to most employers outside of the care sector.

New Entrant (Option E)

If the individual you want to sponsor meets the criteria to be classed as a ‘new entrant’, then you can pay less. We’ve set out the criteria below, but it gets quite technical in places. There’s also a requirement to leave a sponsor note after you’ve assigned a Certificate of Sponsorship to a new entrant, explaining how they meet the criteria.

If you’re looking to sponsor someone as a new entrant, you should consider taking legal advice. We’ve also written more on the subject in our specialist article: Sponsoring a Skilled Worker Under the New Entrant Rate.

The most common ways to meet the new entrant criteria are where the person:

- is aged under 26 at the time they apply for their Skilled Worker visa;

- is a ‘recent graduate’ – this means someone whose current or most recent grant of leave was as a student / Tier 4, and that leave expired not more than two years prior to the date of the Skilled Worker visa application. The individual must have been studying at degree level or above, and must:

- have completed the course;

- be applying no more than three months prior to the expected completion of the course; or

- be studying a PhD and have completed at least 12 months’ study in the UK towards that PhD;

- holds valid permission to stay under the Graduate route, or their most recent grant of leave was under the Graduate route, which expired less than two years prior to the date of the Skilled Worker visa application (unless the individual has since held leave as a visitor).

If one or more of the above are met, you can pay a minimum of £30,960 or 70% of the going rate. The minimum hourly rate of £15.88 will still apply.

New Entrant – Example

ABC Co Ltd wants to sponsor Corinne, a Singaporean citizen, as a Web Designer under SOC code 2141. Corinne will be 23 when she applies for her Skilled Worker visa, and she will work 40 hours per week.

ABC Co Ltd must pay Corinne an amount equal to or greater than each of the following:

- the reduced general minimum threshold of £30,960

- the going rate for code 2141, which is reduced by 30% to £14.83 per hour

- £15.88 per hour

Let’s pro-rata these figures for a 40-hour working week.

The general minimum threshold is unchanged for a 40-hour working week, as it doesn’t need pro-rating for anything up to 48 hours: £30,960.

The going rate works out at £14.83 x 40 (hours per week) x 52 (weeks per year), for a total annual minimum salary of £30,846.40.

The hourly rate of £15.88 is unchanged for new entrants, which works out at £15.88 x 40 (hours per week) x 52 (weeks per year), for a total annual minimum salary of £33,030.40.

Since £33,030.40 is the highest of these three amounts, that is the minimum that Corinne must be paid as a new entrant.

This is a discount worth having. If Corinne wasn’t a new entrant, her sponsoring employer would need to pay the full going rate of £21.18 per hour, or £44,054.40 per year.

While this might be an acceptable cost for a more experienced worker, the discount will continue to make it more attractive and more viable for sponsors to employ workers at the start of their career, which has to be a good thing for everyone.

Key Personnel – Who Can Manage the Licence?

When you apply for a sponsor licence you must nominate certain key personnel. There are various roles to fill, although these can all be filled by the same person. Whether you will split these roles across different people, or in the case of Level 1 Users have multiple appointees, depends on factors such as the size of your organisation and the number of individuals you are likely to sponsor.

You will need to identify who will carry out the roles when you apply for your licence.

There are three key roles, as follows:

The Authorising Officer

The Authorising Officer has overall responsibility for the licence. They do not have access to the sponsor management system (the web-interface through which the licence is administered), unless also appointed as Level 1 User. The Authorising Officer decides who should be a Level 1 User (or Level 2 User).

The Authorising Officer should be ‘the most senior person in your organisation responsible for recruitment’. This allows the employer some leeway, with often either a director or head of HR being appointed for this role.

The Level 1 User

The Level 1 User is responsible for the general administration of the licence and has access to the sponsor management system. Although you can only appoint a single Level 1 User when you apply for a licence, you can appoint additional Level 1 Users once you have a licence.

The Home Office cautions against having more Level 1 Users than you need, yet also states ‘you should make sure you have at least enough to be able to cover periods of sickness or leave’.

Aside from rare exceptions, you must always have a Level 1 User that is a ‘settled worker’.

You must also have at least one Level 1 User that is an employee, director or partner.

In addition, you can optionally add a Level 2 User. A Level 2 User role is similar to a Level 1 User but with fewer administrative privileges.

Explainer: What is a ‘settled worker’?

A settled worker includes people who:

- Are British

- Hold indefinite leave to remain

- Are granted status under the EU Settlement Scheme (pre-settled or settled status)

- Are UK Ancestry visa holders

Key Contact

The Key Contact is, as the name suggests, the contact between the Home Office and your company.

Suitability and background checks

The Home Office will carry out background checks on key personnel. They are concerned about criminal records and prior immigration issues. Full details are outside the scope of this guide but, if you have any concerns in this regard, do not apply for a sponsor licence without getting this side fully checked out. We would be happy to discuss this with you to assess the suitability of your potential key personnel.

Certificates of Sponsorship

What is a Certificate of Sponsorship?

A Certificate of Sponsorship (CoS) is a virtual document which an employer assigns to their new hire in order to sponsor them. Once assigned, the worker can use a unique code from the CoS to apply for their work visa.

When you obtain your licence, you will not automatically be granted Certificates of Sponsorship. You need to request them, and the process for doing so depends on which type of certificate you need.

In addition, there are deadlines relating to Certificates of Sponsorship. Most importantly, you must assign a CoS within three months of allocation, and the worker must apply for their visa within three months of being assigned a CoS. More on that below in the section: Know Your Deadlines and Timescales.

Types of Certificate

There are two types of CoS: defined and undefined. It’s important to understand which one you need – assigning the wrong one could lead to your licence being revoked by the Home Office.

Before the December 2020 changes, defined and undefined certificates were known as restricted and unrestricted certificates.

Defined Certificates

You need a defined CoS if your migrant worker will be overseas when they apply for their work visa. You can only apply for a defined CoS after the licence is granted. Defined certificates are not subject to an annual allocation, and you can apply for them at any time.

It normally takes a few days for the Home Office to process an application for a defined CoS. That said, we are increasingly seeing the Home Office request further information before it makes the decision, which can delay the process by many weeks.

Undefined Certificates

You need an undefined CoS if your migrant worker will be in the UK when they apply for their work visa. This is usually the case where your migrant worker is in the UK on a different visa (e.g. student), and is switching into the Skilled Worker route.

Undefined certificates are subject to an annual allocation. You first apply to set your annual allocation when you apply for the licence itself. You can then apply to increase your annual allocation at any time, although there’s a standard wait time of up to 18 weeks for a decision on increasing your allocation. There is the option of a priority service which will bring the wait time down to five working days, but this will cost you an additional £200.

Undefined CoS |

Defined CoS |

|

| Which one do I need? |

|

|

| Key features of each |

|

|

How Long Should I Sponsor For?

You can sponsor any individual for up to five years in the first instance. Bear in mind that the individual should qualify for settlement (indefinite leave to remain) after completing five years as a skilled worker. There are pros and cons associated with shorter and longer periods of sponsorship.

If you are liable to pay the Immigration Skills Charge, there are significantly greater upfront costs if you sponsor for a longer duration, as the charge is either £364 or £1,000 per year (depending on the size of your business, see below section on costs). The individual you are sponsoring also pays more up front, with the Immigration Health Surcharge costing £1,035 per year. Also, the visa fee doubles if sponsorship is greater than three years. You might also not want to commit to sponsoring for a long duration, as you will want to see how an individual performs at their job.

On the other hand, if you sponsor for the full five years, then it is administratively easier for all parties, as you would not need to apply for another certificate of sponsorship and the individual would not need to apply for a visa extension. It is also worth bearing in mind that if the sponsored individual is not up to the job, or terminates their employment early for whatever reason, then you would receive a reimbursement for any ‘unused’ portion of the Immigration Skills Charge, and the individual would receive an apportioned refund on the Immigration Health Surcharge.

Often, my clients will opt for a three-year period, but this is a decision for the business in conjunction with the individual.

For more on the question of sponsorship duration, see our blog here.

How Do I Show the Job is ‘Genuine’?

What Does the Home Office Want to Know?

On 1 December 2020, the resident labour market test was abolished. This was a Home Office-mandated recruitment exercise by which you had to show that no ‘settled worker’ could do the job. It was time-consuming and laborious, and we haven’t missed it.

All that remains of the resident labour market test is the requirement to show that a vacancy is genuine, and the best way to do this is through some form of advertising. A big part of what we do for our sponsor licence clients is reviewing adverts and advising them on how to meet this requirement. We’re proud to say we’ve had plenty of licences granted on the strength of our advice. Read on below for more information, and get in touch if you’d like us to review your advertising too.

Do I Have to Advertise?

In short, usually yes. It’s not exactly clear in the main sponsor guidance documents, but this extract from Appendix A is telling:

“If you have not advertised for the job and the person you wish to employ is not currently working for you, you should confirm how you identified that this person was the most suitable for the job”.

So there’s a pretty strong general expectation that you will need to advertise for the position, although you no longer need to go through the strict formalities of the resident labour market test.

Appendix D elaborates further, suggesting that you should retain on file a record of applicants, interview notes, your chosen candidate’s CV, and any other relevant information or evidence of how you arrived at the decision that your worker to be sponsored was the best person for the job.

Where the individual you want to sponsor has already been working for you, there’s no need to advertise. Instead, you should include with your application three months’ worth of payslips demonstrating the existing relationship.

What About the Job Description?

Adverts and job descriptions normally go hand-in-hand, and the Home Office will expect to see a copy of your job description for the role to be sponsored. You should submit a copy with your licence application, and you will need to give details again when you apply for and assign Certificates of Sponsorship.

Your job description should therefore be well thought out from the start, as the Home Office will hold you to it as you move through the process of sponsoring workers.

Here’s our advice:

- The job description should match the description which is recognised by the Home Office – available here by entering the SOC code.

- The job description should also match the duties to be performed by your sponsored worker on a day-to-day basis. The Home Office is particularly concerned that the sponsored worker should not be doing work outside their designated occupation code, particularly not ‘lower-skilled’ duties. The Home Office will be on the lookout for job descriptions which appear exaggerated, and if you are inspected you can expect a close examination of the exact duties that any sponsored migrant has been performing.

Know Your Deadlines and Timescales

Preparing to Sponsor

If you are applying for a sponsor licence to hire a specific individual, then it takes some careful planning to work out when you need to apply for a licence and when your prospective sponsored employee can start work.

There are various sneaky deadlines and time limits which, if you are not aware of and have not factored in, can seriously undermine your plans. You should also be aware of general processing times.

Here is what you need to know:

- As the resident labour market test is gone, there is no need to allow for a minimum 28-day recruitment exercise. However, as explained above, often you will still need to show you have tried to recruit domestically before sponsoring, so any recruitment exercise may need to be factored in.

- The Home Office processes 8 out of 10 applications within eight weeks, and we’re commonly seeing decisions being made at around that eight-week mark. Priority service is available but difficult to obtain – for more on that weird process, see our article here. An important caveat to all of this is that if the Home Office visits you before they grant the licence, your application could be delayed by several months.

- If you need a defined certificate of sponsorship, then this would need to be applied for after you are granted a licence. Straight forward decisions should only take a few days, but if further information is requested can take many weeks.

- A defined certificate of sponsorship must be used within three months of allocation, otherwise it will be removed from your account.

- Once the certificate is assigned to the individual, they must apply for their visa within three months.

- Note that the migrant worker cannot apply for their visa more than three months prior to the ‘start date’ as recorded on the certificate of sponsorship.

- In terms of the visa processing, there is a three-week wait for a decision. However, an individual can pay for the Priority Service and get a decision within five working days. The wait time for a visa application from within the UK is eight weeks, or five working days if using Priority Service. This can be reduced to one working day if using Super Priority service.

Sponsor Licence Compliance

What is Sponsor Licence Compliance?

When the Home Office talks about sponsor licence ‘compliance’, it is talking about the duties and responsibilities you agree to take on when you apply for a licence. The Home Office takes compliance very seriously, which is why you are supposed to be well versed in the Home Office’s 63-page document on this very issue.

In allowing organisations to sponsor, the Home Office considers the sponsor to have taken on certain responsibilities around ‘keeping tabs’ on the migrant. You need to show the Home Office that it can trust you.

If you want to deep-dive into sponsor licence compliance, then check out our dedicated guide.

Compliance is For Life

When applying for a licence, most employers are aware of a need to ‘get HR in order’. Depending on your profile, you may be more or less likely to be inspected before the Home Office grants a licence. This is known as a pre-licence inspection. Because of the risk of a pre-licence inspection, you should have adequate systems in place from the word go.

Many sponsors manage to avoid a pre-licence inspection but then fall into the trap of forgetting about their sponsor duties. This then causes major problems down the line when they are told that they will be inspected at short notice.

Our advice therefore is to ensure you have a proper understanding of compliance and have appropriate systems in place when you apply for a licence.

As part of our service, we will provide a quick reference guide to your sponsor licence duties, tailored to your business.

When is a pre-inspection visit more likely?

Risk factors:

- You are recently incorporated or trading

- The business is at your personal address/virtual office

- You are in a ‘high risk’ sector, e.g. hospitality

- You are sponsoring someone related to an existing employee

- You have had previous immigration issues

- You have provided information in the application which casts doubt

Key Areas of Compliance

Some of the key areas of sponsor licence compliance are below – although the Home Office expects you to be familiar with its 63 page guidance document.

Reporting duties

There are various changes you must report to the Home Office and these attract either a 10-working day or 20-working day deadline to report. There are many changes in circumstances that you must report to the Home Office, but here are a few examples:

- If your sponsored employee is absent from work for more than 10 consecutive days without permission (report within 10 working days)

- If you stop sponsoring the employee (10 working days)

- A change in the employee’s location (10 working days)

- If you sell all or part of your business (20 working days)

Record keeping duties

Again, it is beyond the scope of this guide to go through all your record keeping duties. However, compliance is one of the most important ones and a key focus of any inspection.

The record keeping duties are set out in the general guidance, as well as in the guidance document Appendix D.

Sanctions for Non-Compliance

Licence refusal

If you do not comply with your sponsor licence duties, there are serious repercussions. For example, your licence application could be refused. If you are refused, then you will normally be subject to a six-month ‘cooling off period’, during which you cannot reapply. A refusal, as well as the subsequent cooling-off period, can be extremely detrimental to your recruitment plans.

Sponsor licence suspension or revocation

A common mistake made by licence holders, is to apply for the licence and then to basically forget about or neglect the ongoing compliance duties. This can be disastrous both for the business and the individuals that have been sponsored.

If you already have a licence in place and are found to be in breach of your sponsor licence duties, then you might receive notification that your licence is being suspended. During the suspension, you can continue to sponsor workers but you cannot sponsor new ones. The Home Office will then decide whether to reinstate, downgrade or revoke your licence.

The Home Office will usually revoke, rather than downgrade. If your licence is revoked, then you must stop sponsoring any individual. The individual will then have their visa curtailed. This usually leaves them with insufficient time to find an alternative immigration route and they are forced to leave the UK.

If the licence is revoked, you will normally have a 12-month ‘cooling-off period’ during which you cannot apply for another licence. In addition, the Home Office will scrutinise any subsequent licence application.

Preparing For a Compliance Visit

The Home Office aims to audit all licence holders at some point. You can either be audited before being issued with a licence, or after. You could either have an on-site inspection or a remote compliance check.

During any visit, a Home Office compliance officer will hold in depth interviews with the Authorising Officer and Level 1 User, as well as any sponsored migrants.

The Home Office will be meticulous in examining the role any sponsored migrant is (or will be) undertaking, to assess whether the role is genuine. They will want to know that you are complying with your record keeping and monitoring duties. They will also want to know what systems you have in place to check your sponsored migrant’s contact details, and how you are complying with your Right to Work checks.

How Truth Legal Can Help You to Become Compliant

At Truth Legal, we help you to become compliant. If you instruct us to help you with your sponsor licence application, as part of a detailed consultation we will highlight the key compliance issues for your organisation. We can also discuss ways in which you can devise compliant HR systems. In addition, we will provide you with a quick reference guide to your sponsor licence duties, tailored to your business needs.

Our HR Compliance Package

To help you implement compliant systems, we offer two types of compliance support packages.

Our most popular is our Pre-Licence Compliance Report – designed exclusively by Truth Legal. This involves us collaborating with you to provide detailed compliance report to be submitted to the Home Office at the time of applying for a licence. The purpose of this package is to head-off any potential audit, by volunteering the required information upfront – leading to huge potential savings in terms of time and money.

Mock-audit

We can carry out a mock audit of your HR systems to check compliance, which can be done remotely or on-site. We will then write an Action-Plan to let you know which areas are compliant and which need improving.

Making representations and judicial review

If you have had a sponsor licence application refused, or if your licence is at risk of being revoked, then we can help. We will review your case and decide on the best approach. Often we find that writing a detailed letter (making ‘representations’) on your behalf leads to a positive outcome.

Where necessary, we will write a letter before a claim and running judicial review proceedings.

If you want to discuss how you can become compliant, contact us today.

Applying for a Sponsor Licence

By the time you are ready to apply for a sponsor licence you should either have identified a specific role you wish to sponsor, or have identified the types of roles you are likely to sponsor. You should also be familiar with sponsor licence compliance and have implemented appropriate systems, where possible. You will also need to be clear on who will act as key personnel.

Importantly, you should also have given careful attention to how you can show the vacancy is genuine, or that you are likely to have genuine roles to fill.

If you have covered all the above, then you should be ready to prepare the application itself.

5-Step Guide to Apply for a Sponsor Licence

You can submit the application online – there is no need to submit original documents or certified copies unless specifically requested. You will need to email electronic copies of your supporting documents after submitting the application, or we can do that for you.

Step 1: Get your documents ready

The Home Office document Appendix A tells you which types of documents you will need to support your application. Appendix A is not particularly user-friendly. You have to work your way through a series of ‘tables’ to work out which documents you need. You need to have four documents on the list as a minimum, although it’s always our advice to submit as many documents as you can. Four is good, five or six is better.

Beware that some documents are mandatory. For example, if you are a start-up (defined as operating or trading for less than 18 months) then you must include bank statements or a letter from your bank. In addition, franchises must send a franchise agreement signed by both parties. If you are a food business, then you must provide evidence of registration/approval by a food authority, such as evidence of your ‘Scores on the Doors’ rating. Also, if you have audited accounts, then these must be submitted.

Don’t forget the hierarchy chart! This must detail any owner, director and board members. If your organisation has 50 employees or fewer, then you must include the name and title of each staff member.

As part of our service, we’ll review your evidence in full, identify any gaps or shortcomings, and then help you fix them. Better to hear it from us than the Home Office!

Step 2: Write your cover letter

We are often asked ‘Do I need to write a cover letter?’, to which our answer is a resounding ‘yes!’. If you instruct us to help you with the application process, then we consider this to be perhaps our most important task. There are two reasons why you need a good cover letter.

Reason 1: You must submit mandatory information

If you are applying under the Skilled Worker category, then you must submit certain mandatory information as requested in Appendix A. If you do not do this your application will probably be rejected, so getting across this information is just as important as providing the supporting documents.

Our approach is to include this information in a cover letter.

Reason 2: Your cover letter allows you to paint a picture

Your cover letter gives you the chance to build a compelling case for why you need a licence. For example, you might set out your company background in a glowing light. Or you might want to highlight past difficulties in recruiting, explain how an individual you want to sponsor has previously worked for you, or explain your expansion plans.

Step 3: Complete the online application

Once you have your documents ready, you can submit the online application. You can apply for the licence here: https://www.gov.uk/apply-sponsor-licence

If we’re on board, we’ll complete the application on your behalf. We’ll also enter our own details as your legal representatives.

Step 4: Send supporting documents by email

Once you have submitted your online application, you will need to print off a ‘Submission Sheet’ and complete it. You then need to email this to the Home Office, along with the rest of your supporting documents. You have five working days to email your documents.

The Home Office asks that you submit all documents in PDF form and that all attachments are suitably labelled, using no more than 25 characters.

Step 5: Consider applying for Priority processing

You have the option of purchasing the priority processing service. This optional service will cost an additional £500 and should normally bring a decision within two weeks (although we often get decisions within a matter of days).

Niche Sponsor Licence Issues

Can I Sponsor a Family Member?

A common question we are asked, is whether it is possible to sponsor a family member. The answer is ‘yes’, but it is complicated, and you will need to make important allowances.

Prohibition on a Level 1 or Level 2 User assigning a certificate of sponsorship to a family member

In terms of the outright prohibitions on sponsoring family members, the only categorical ban is on ‘SMS users’ assigning a certificate of sponsorship to a ‘close relative or partner’. ‘SMS users’ means a Level 1 or Level 2 user. ‘Close relative or partner’ is interpreted widely, to cover:

- a spouse, civil partner, unmarried or same-sex partner

- a parent or step-parent

- a son or step-son

- a daughter or step-daughter

- a brother, step-brother or half-brother

- a sister, step-sister or half-sister

- a nephew, niece, cousin, aunt or uncle. father-in-law, mother-in-law, brother-in-law, sister-in-law, son-in-law or daughter-in-law

Taken at face value, this prohibition merely restricts the Level 1 or 2 User from undertaking the specific act of assigning the certificate of sponsorship to the family member. Therefore, this provision does not necessarily prevent a family member from acting as a Level 1 User. For example, it might be possible to appoint multiple Level 1 Users or another Level 1 or 2 User to undertake the specific act of assigning the certificate.

Appointing a different Level 1 User can be difficult for certain businesses, particularly smaller ones. There are other requirements which create further hurdles, such as the requirement that you must always have a Level 1 User that is either a director, partner or employee. You must also have at least one Level 1 User that is a ‘settled worker’.

Possible ways around this include appointing a legal representative as your Level 1 User, or appointing an ‘employee of a third-party organisation engaged by you to deliver all or part of your HR function’.

Requirement to disclose to the Home Office if you assign a certificate of sponsorship to a family member

You must also disclose to the Home Office if you assign a certificate of sponsorship to a family member of anyone within the sponsor organisation if your organisation is classed as a small or medium business. If it is a large business you only have to do this if you are ‘aware’ you are assigning a certificate to a family member of someone within your business. Disclosure is made by way of a sponsor note. For a definition of what is classed as a small, medium or large business, see the below section on costs.

Expect scrutiny

Even if you navigate these tricky issues, the Home Office will scrutinise you closely if you sponsor a family member. A likely point of attack by the Home Office is the ‘genuineness’ of the role, so you will need to have this aspect clearly covered.

In summary, sponsoring a family member is in theory possible, but you must make key adjustments and even if you make those adjustments, you must make sure you are extremely compliant. You should take legal advice before going down this tricky route.

There’s lots more information on this in our article here.

Can I Be Sponsored by a Business I Own?

Again, the answer is yes on paper, provided you pay careful attention to the limitations of doing this and are prepared for extra scrutiny.

Two changes make this more doable. First, the abolition of the resident labour market test clears a potentially awkward hurdle. Second, there used to be a general prohibition on tier 2 visa holders owning more than 10% shares in their sponsoring company. There is no such restriction under the Skilled Worker route.

However, other challenges remain. First, your business must be ‘operating or trading’ before it can get a licence. So you may need to enlist help to establish the business in the UK if you wish to set up a new business. Alternatively, you might be able to do limited work on a business visitor visa.

You would need to have suitable persons in place to act as the Authorising Officer and Level 1 User, as you could not take on these positions. This is a tricky area so you should contact us if you want to go down this route.

Dealing With Rejection or Refusal

Receiving a negative decision can come in two forms: a rejection or a refusal, and it is important to understand the difference between the two.

Refusals

A refusal means the Home Office is not satisfied that you can meet the requirements of sponsorship. There will normally be a ‘cooling-off’ period, during which you cannot reapply. This usually lasts for six months but it can be longer. There is no right of appeal against a refusal and no formal process to request a reconsideration. Also, you will not receive a refund of your application fee.

However, at Truth Legal we have had success in persuading the Home Office to overturn refusals and cooling off periods, by making detailed representations on our clients’ behalf. Contact us today if you need help with a refusal.

Alternatively, it might be a case of making a new application, addressing any points of refusal. Again, at Truth Legal we are experienced at helping you to build a compelling case in circumstances where you have previously been refused or had other issues.

Rejections

A rejection usually happens if you don’t submit some mandatory information or evidence. You will normally receive a refund and you can re-apply straight away.

How Much Does Sponsorship Cost?

There are various costs involved with sponsorship. The employer must cover some of these. Other costs are the liability of the sponsored individual.

Below is a brief summary. For a full analysis, read our article here.

Note that some of the sponsor fees vary depending on whether the employer is a charity/small business or a medium/large business. You are a small business if two of the following apply:

- your annual turnover is £10.2 million or less

- your total assets are worth £5.1 million or less

- you have 50 employees or fewer

Employer costs |

Individual’s costs |

|

| Sponsor licence (one off fee) | £536 (charity/small), or

£1,476 (medium/large) |

n/a |

| Cost of one certificate of sponsorship | £239 | n/a |

| Immigration Skills Charge | £364 (charity/small), or

£1,000 (medium/large) per sponsored migrant per year * |

n/a |

| Skilled Worker visa | n/a | £719/£1,420 if sponsored for less/more than three years and applying from overseas,

or £827/£1,500 if sponsored for less/more than three years and applying from within the UK ** |

| Immigration Health Surcharge | n/a | £1,035 per year of the visa (e.g. a three year visa would be=£3,105 |

* If an individual is switching from being on a Student visa then they will exempt you from paying this charge. However, following recent changes, the general rule is that only students who complete their course can now switch into the Skilled Worker route.

** lower fees apply if the job is on the shortage occupation list and/or if the visa is a ‘Health and Care Visa’

Watch Our Video – How To Apply For A Skilled Worker Sponsor Licence

Truth Legal – Sponsor Licence Experts

We hope you’ve found this guide useful. We’ll continue to update it as we spend more and more time navigating our way through the new Skilled Worker system.

We’re doing these applications day in, day out, and we have no hesitation in describing ourselves as sponsor licence experts.

If you instruct us, we won’t let you submit an application until we’re confident of success. Our services are priced competitively under an innovative staged approach, which puts you in control of your own fees.

If you’d like us on board, you can start the process here with a free consultation.

More Legal Guides

Comprehensive and free legal guides from Truth Legal Solicitors.