Imagine that you and your neighbour have both been injured in separate road traffic accidents.

Neither of you was at fault; neither of you was even driving at the time.

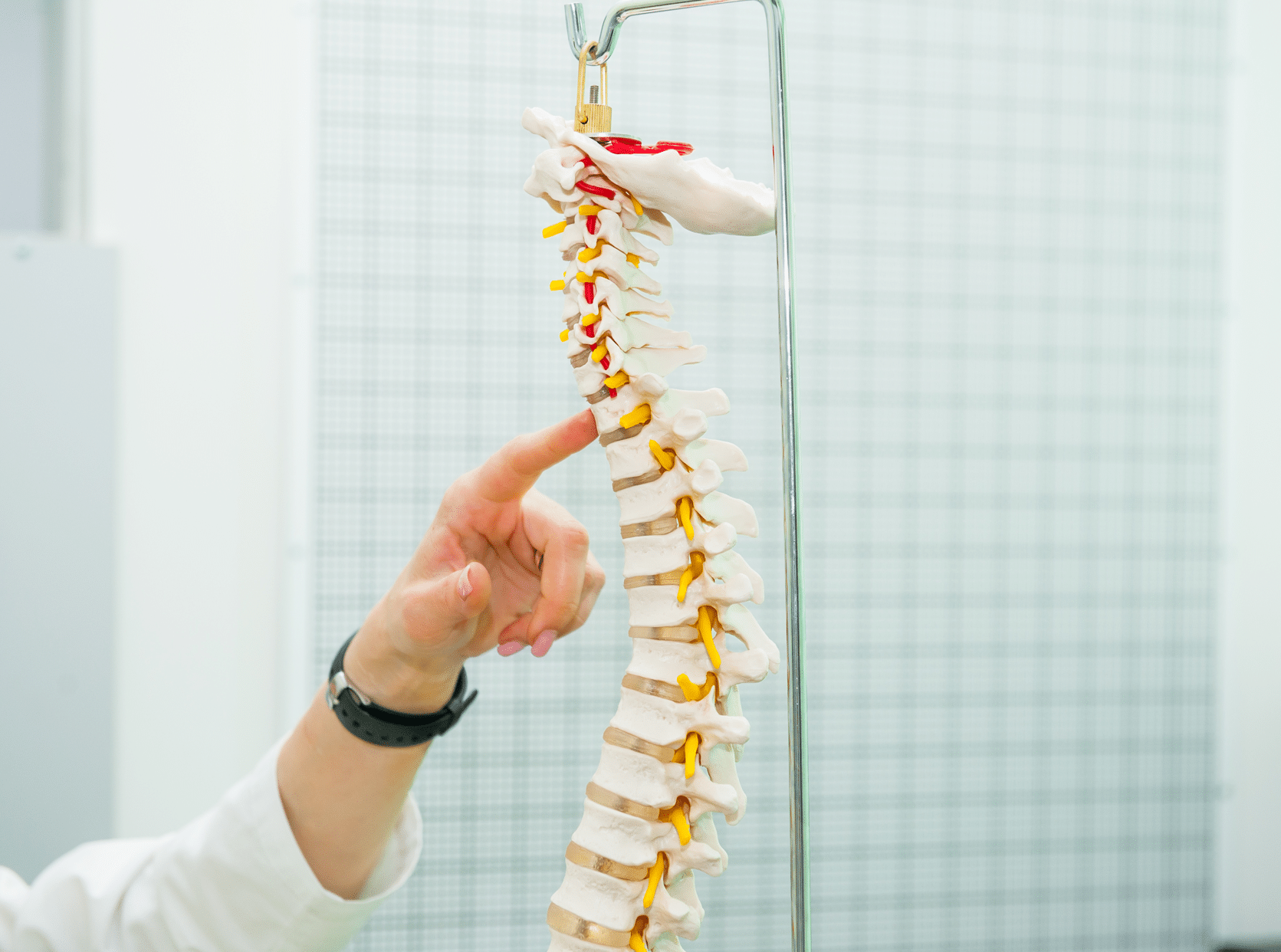

Imagine also that, for 6 months, each of you suffered the pain, frustration, and debilitating effects of a whiplash injury to the neck. Starting out in near-constant pain, gradually easing, and then recovering half a year later. All because of the carelessness – the negligence – of the drivers that injured you.

You both make claims for compensation.

Your neighbour receives £2,600 for their injuries.

You receive £495 for yours.

The only difference? Your neighbour was injured as a pedestrian and you were the passenger in a car. There was no difference in who was at fault or in the injuries you suffered but, because they were a pedestrian, your neighbour’s claim avoids the unjust effects of the 2021 Whiplash Reforms. Yours does not. So you receive £495 to compensate you for 6 months of pain and suffering and for the effect that this has had upon your enjoyment of life.

Sadly, from the 31st May 2021, this will be the reality for many people injured in road traffic accidents.

What are the 2021 Whiplash Reforms?

You can read all about the details in our 2021 Whiplash Reform Guide and FAQ but, in a nutshell, the reforms change the way in which whiplash injury claims, arising from road traffic accidents, are handled under the law. They will affect your claim if:

- You were injured in a road traffic accident where you were inside a motor vehicle (i.e. a driver or passenger).

- The accident occurred on or after 31st May 2021.

- You suffered whiplash injuries.

- Your injuries are worth less than £5,000 and the total value of your claim is less than £10,000.

Whiplash injuries which last less than two years (the vast majority) are now to be valued according to a tariff – a rigid table of values which only considers the injury’s duration and, to a limited extent, whether you also experienced any psychological symptoms. That’s where the £495 figure mentioned above comes from.

To be honest, it’s unlikely I could write anything quite so damning as the tariff itself. So here it is:

| Duration of Injury | Amount (for Whiplash Alone) | Amount (for Whiplash and Minor Psychological Injury) |

| Not more than 3 months | £240 | £260 |

| More than 3 months, but not more than 6 months | £495 | £520 |

| More than 6 months, but not more than 9 months | £840 | £895 |

| More than 9 months, but not more than 12 months | £1,320 | £1,390 |

| More than 12 months, but not more than 15 months | £2,040 | £2,125 |

| More than 15 months, but not more than 18 months | £3,005 | £3,100 |

| More than 18 months, but not more than 24 months | £4,215 | £4,345 |

You are probably thinking that it is not worth bothering to make a claim for a whiplash injury. And you could well be right, unless you have suffered high amounts of other losses because of the accident, such as lost earnings.

But, if you do decide to claim, another part of the reforms steps in to make it more difficult for you: if you make a claim for whiplash injuries following a road traffic accident it’s likely you will be doing so on your own – without legal support. This is because under the new process, which these whiplash injury claims now have to follow, legal costs cannot be recovered as part of the claim.

No personal injury solicitors allowed

I have already recorded my rage at this shocking attack on civil justice. Without the possibility of including legal costs in a claim, personal injury solicitors like Truth Legal will be unable to take on the work involved in a whiplash injury claim.

A new Official Injury Claim portal is now the method by which injured people will make their whiplash injury claims. It is intended to guide claimants through each stage of their claim, from obtaining medical evidence, valuing their own injuries, proving their other losses and negotiating settlement with the insurance company from which they are claiming.

The government’s FAQ on the Whiplash Reforms discusses the process further – I’ll leave you to decide how convincing you find their answers.

You might be thinking: “Well, of course you’re against all this. You’re a solicitor and these changes mean less money for you.” And that’s true, they do mean less money for me. But I am also a solicitor who believes that lawyers are a genuine force for good in society. Because what becomes of accountability and justice without lawyers to fight for your rights?

And that’s the point. The Whiplash Reforms don’t remove all lawyers from the situation, just yours – the injured claimant’s. The insurance company you are claiming from will still have their in-house legal teams or their preferred firms of solicitors to defend claims if they so wish. Insurers have succeeded in stacking the deck in their favour.

Why are these changes happening?

The changes represent a substantial victory for motor insurance companies, who, for a long time, have been lobbying governments to do something to reduce the numbers and costs of whiplash injury claims.

The reforms target claims from the most common kind of road traffic accident victim – occupants of motor vehicles. And whilst it is welcome that more vulnerable groups of road-user (pedestrians, motorcyclists, cyclists, and people riding scooters) are excepted from the changes, it is still baffling how the government can justify treating vehicle occupants as ‘2nd-class’ claimants, simply because accidents involving them are more widespread.

Will this reduce motor insurance premiums?

Motor insurers have stated that saving money in compensation awards and legal costs will allow them to pass savings on to their customers by reducing insurance premiums. Perhaps they will.

However, figures from the Department for Work and Pensions Compensation Recovery Unit show that the numbers of motor claims have fallen consistently over the last 10 years: from 790,999 claims registered in 2010-11 to 653,052 in 2019-20. Yet I am unaware of any insurers who have lowered their premiums on this basis.

The legislation implementing these reforms does contain provisions for checking whether insurers have passed savings on to their customers – but they are essentially toothless. Insurers have to provide information to the Financial Conduct Authority (FCA) on how the savings have been passed on – by 2024. At which point, according to the government FAQ mentioned above, the FCA will “assess whether the industry has passed on the benefits of the reforms to consumers, and a report will be made to Parliament after April 2024.”

Final thoughts

If a person is injured through the fault of someone else, who would dispute that they are entitled to some form of redress?

Our legal system, rightly, demands that an injured party proves both the harm they have suffered and their entitlement to redress for it. Through denying legal support and imposing the new tariff, the 2021 Whiplash Reforms – in one stroke – limit the injured person’s ability to prove their claim and reduce the compensation they get if they do so.

Compensation awards should always take into account the severity of, and the harm caused by, an injury. But the reforms seem to be creating a separate ‘channel’ of justice where a seemingly irrelevant circumstance (whether you were inside a motor vehicle or not) can have a drastic and arbitrary effect on the kind of compensation award you can expect to receive.

Unfortunately, thanks to these ill-considered reforms, claimants suffering the most common kinds of injury in road traffic accidents will also be suffering this injustice in addition to their whiplash symptoms.

If you would like to know more about the details of the 2021 Whiplash Reforms, please read our guide and FAQ.

VIDEO: Watch Andrew Gray’s rant about the whiplash changes here:

Further Reading

From one of the UK’s most read legal blogs.