The Immigration team at TL has been catching their breath in early 2024, amidst a flurry of significant changes, particularly concerning the sponsorship of Skilled Workers and family-based migration.

With the recent Statement of Changes shedding light on the post-April 2024 immigration system, we now have a clearer direction. However, navigating the new system poses considerable challenges for employers, workers, and family members alike.

In this blog post, I’ll delve into the intricate matter of minimum salary rules affecting the sponsorship of Skilled Workers. This is essential reading for any employer contemplating sponsoring overseas nationals, as it will help determine the feasibility of sponsorship under the new regulations.

We’ve written a separate blog post on how the changes will affect the care sector, available here: How to Sponsor a Care Worker in April 2024 (and Beyond)

Three systems!

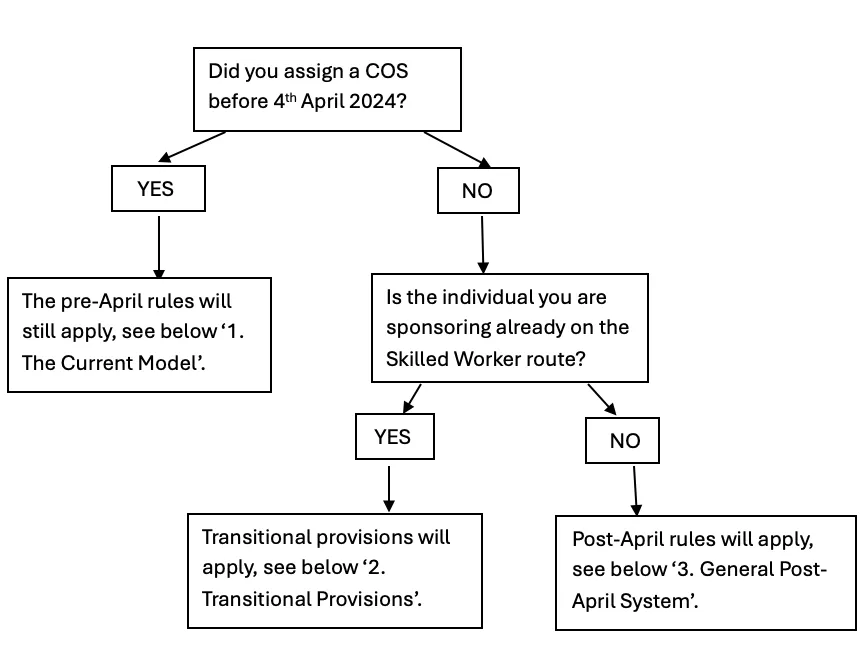

There are essentially three sets of rules now, in the short-term at least. As an employer, you must identify which applies to your sponsored worker.

(We’ll leave care workers out of this as they’ve got their own peculiarities and we’ll deal with those minimum salary changes, along with those to family-based visas, in separate blogs. )

We’ve created this flow chart to help you figure out which system applies.

1. The Current Model

Although sweeping changes are afoot, at the time of writing, there’s still the pre-4th April 2024 system, the ‘current system’: a land of £26,200 thresholds, relatively low going-rates, and the Shortage Occupation List.

Importantly, if you assign a CoS before 4th April 2024, then your worker’s application will be considered against the pre-April rules, even if the visa application is submitted after 4th April. Note, however, that the latest the worker can submit their visa is three months after the CoS assignment, hence this current model will not be needed after 4th July 2024.

Warning! Home Office systems will be down from 2nd to 4th April 2024, so in effect, if you want to benefit from the current rules, the latest you can assign a CoS is 1st April 2024.

The ‘current model’ in action: Jean-Pierre

Jean-Pierre works as a chef on a temporary visa, due to expire in July. His employer cannot afford to pay the post-4th April fees. His employer can pay Jean-Pierre £26,769.60, based on 45 hours per week, complying with the following minimum salary threshold considerations.

- The general minimum salary threshold of £26,200

- A going-rate of £8.77 per hour

- The national minimum wage of £11.44, effective from 1st April 2024

The employer has worked out the salary as follows: £11.44 x 45 (hours per week) x 52=£26,769.60, thereby ticking all boxes.

But this will only work if the CoS is assigned before 4th April 2024.

2. Transitional Provisions

These apply if:

- If you’re assigning a CoS after 3rd April 2024

- You are sponsoring an individual already on the Skilled Worker route (g., extending sponsorship or switching employers)

These transitional provisions are far more generous than the general ones that apply post-April 2024, and which we explore below.

Under these provisions, the general minimum salary threshold increases from £26,200 to £29,000. Additionally, the going rate for various positions will increase, albeit more moderately and still based on the 25th percentile of earnings. For example, under the transitional arrangements, the going rate for a sales manager will increase from £18.00 to £20.05 per hour.

In addition, the general minimum hourly rate of £10.75 increases to £11.90.

The transitional provisions in action: Joe

Joe has been sponsored by his employer since 2023 as a restaurant manager. His employer now wants to sponsor him for an addition 3 years, assigning the CoS after 4th April 2024.

As Joe is already on the Skilled Worker route prior to 4th April 2024, he qualifies under the transitional provisions. When Joe’s employer next assigns the CoS post-4th April 2024, it will need to pay at least £11.90 per hour and meet the general minimum salary threshold in transitional cases of £29,000.

3. General Post-April System

It’s now time to look at the general, full-fat system facing new hires from 4th April 2024. It’s restrictive and makes for painful reading.

Who qualifies under this new general system?

- This system applies to new hires with a CoS assigned on or after 4th April 2024.

- To qualify, the worker must not already be on the Skilled Worker route prior to April 4, 2024

The general minimum salary threshold rises significantly to £38,700, though discounts are available in certain circumstances.

Also, beware that the ‘going rate’ for each job code is increases significantly, as the Home Office uses median rates rather than basing earnings on the 25th percentile.

There is a general minimum hourly rate of £15.88, which will apply regardless of any ‘discount’.

The ‘general post-4th April system’ in action: Dave

Dave will be sponsored after 4th April 2024 as a business development manager. He’s not already on the Skilled Worker route. His employer decides to set his pay at £50,394.24 based on 36 hours per week, complying with the following minimum salary threshold considerations.

- The general minimum salary threshold of £38,700 (up from £26,200)

- A going-rate of £26.92 per hour (up from £12.10)

In this instance, it is the massively hiked hourly rate of £26.92 which is the chief concern. Salary workings as follows: £26.92 x 36 (hours per week) x 52=£50,394.24

Discounts

Thankfully minimum salary reductions are still available, for specific situations.

News of the ‘new entrant’ discount being retained is a relief. A new entrant includes workers under 26, those switching from the Graduate Route and ‘recent graduates from a UK university’ – see more about who meets the definition of a new entrant in our related blog. New entrants only need to be paid 70% of the going rate and the general minimum salary threshold drops from £38,700 to £30,960.

Inclusion on the Salary List reduces the general threshold to £30,960. However, unlike with the pre-April 2024 system, inclusion on the List does not bring a discount to the going rate.

Discounts are also still available where the worker has a PhD in a subject relevant to the job (90% of the going rate and £34,830 as a general threshold), or for PhD in a STEM subject relevant to the job (80% of the going rate and a £30,960 general threshold).

The Salary List in action: Millie

Millie is going to be sponsored after 4th April 2024 as a roofer. Her employer decides to set her pay at £31,005 based on 37.5 hours per week, thereby complying with the following minimum salary thresholds:

- The general minimum salary threshold of £30,960 (reduced from £38,700 due to roofers being on the Salary List)

- A going-rate of £15.90 per hour, up from £10.36 (there’s no 20% discount to the going rate for being on the Salary List)

For Millie’s employer, the going rate has increased significantly and there’s no going-rate discount despite roofers being on the Salary List. However, attracts a discount to the general minimum salary threshold: £30,960. The employer has worked out the salary as follows: £31,005 x 37.5 (hours per week) x 52=£31,005 – ticking all boxes.

Discounting for a new entrant under the new system: Ashraf

Ashraf is going to be sponsored after 4th April 2024 as a head chef. His employer decides to set his pay at £30,966 based on 37.5 hours per week, complying with the following minimum salary thresholds.

- The general minimum salary threshold of £30,960 (a 20% reduction from £38,700)

- An hourly rate of £15.88 per hour

For Ashraf’s employer, as a new entrant the general minimum salary threshold is reduced to £30,960. However, general minimum hourly rate of £15.88 still applies here. The employer has worked out the salary as follows: £30,966 x 37.5 (hours per week) x 52=£30,966, thereby ticking all boxes.

Beat the changes – can you assign before 4th April 2024?

Consider assigning a CoS before April 4, 2024, to avoid the new thresholds. However, ensure the worker submits their visa application within three months of CoS assignment.

New system, new SOC codes

Employers beware! The Home Office is using a different set of SOC codes. Use the correct to avoid CoS or visa application rejection.

Contact us

Navigating these changes can be complex. For clear advice on immigration matters, including how to navigate these changes, contact us today.

Further Reading

From one of the UK’s most read legal blogs.